The Financial Plot Twists Shaping Your December. Financially Enabled #104 December 4th , 2025

Markets took a breather this week as stocks slipped and Treasury yields crept higher, mortgage rates hovered in the “maybe it’s finally time to refinance” zone, and the Fed quietly stopped hemorrhaging cash for the first time in years, proof that rate cuts are actually reshaping the economy instead of just fueling Twitter debates. Meanwhile, Trump-era tariff shifts with South Korea are lowering costs on cars and tech (a tiny win for your wallet), and housing prices are doing their usual “we’re not crashing but we’re not calming down either” dance, leaving buyers and sellers equally confused but very caffeinated. In short: money is moving, policy is shifting, and your financial plan needs to stretch like it’s joining a 6 a.m. yoga class.

Want the deeper breakdowns, the real strategies, and the behind-the-scenes coaching? Join my Skool,your wealth brain will thank you.

The Fed Finally Stopped Bleeding Cash. Should You Care?

The U.S. central bank just stopped losing money for the first time in three years.

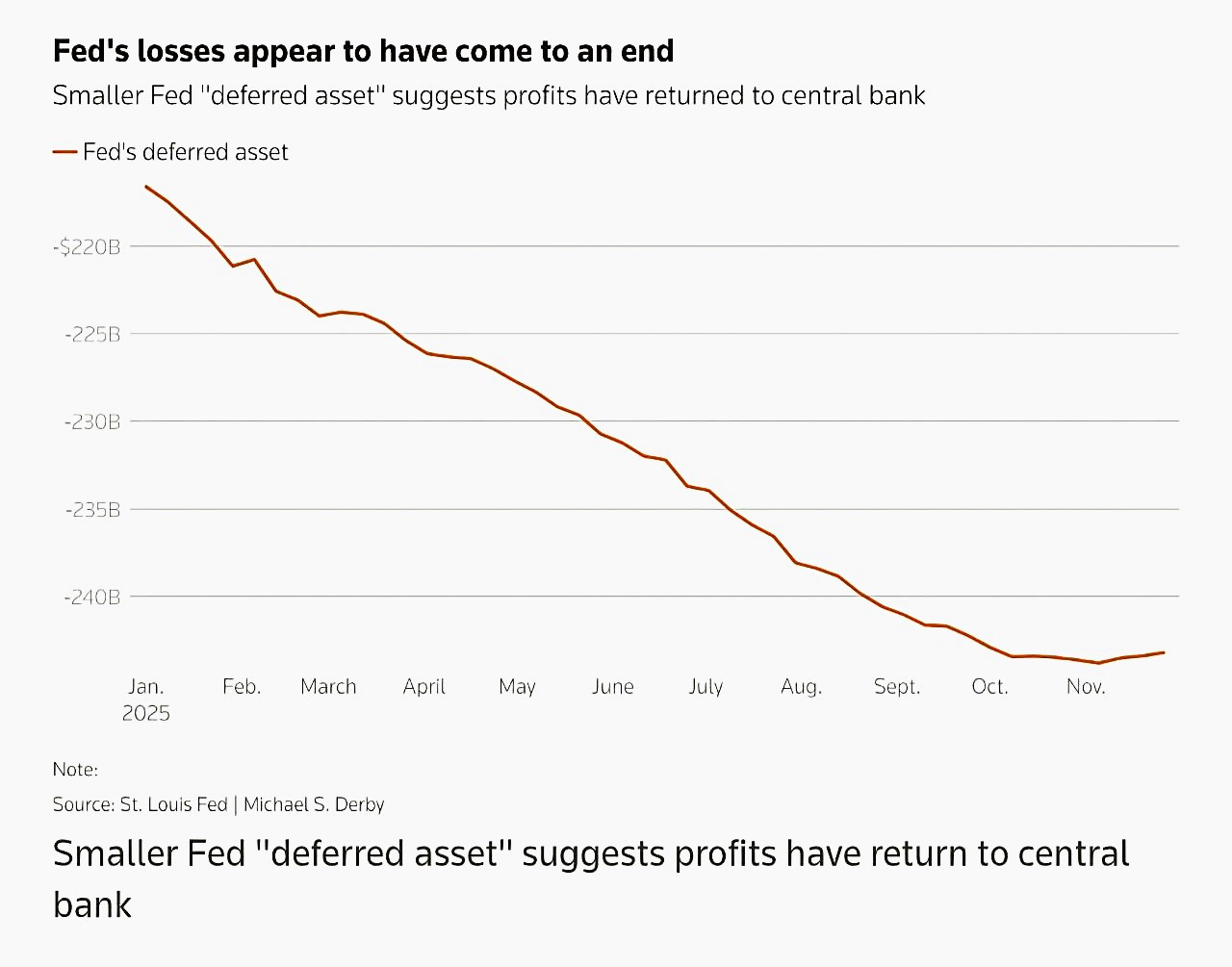

For most of the last three years, the Federal Reserve, the referee of the financial system. has actually been losing money thanks to its pandemic bond-buying binge and later rate hikes. Those moves were meant to keep the economy alive and then cool inflation, but they also forced the Fed to pay out more interest to banks than it earned on its massive bond portfolio. The result: a “deferred asset” (think: IOU of past losses) that ballooned to about $243.8 billion.

Now the tide is finally turning. Fresh Fed data shows that since early November, that deferred asset has started to shrink, down to $243.2 billion, a tiny change, but the first real sign the Fed is generating enough income again to plug the hole. Rate cuts have lowered what the Fed pays out, easing the cash drain and inching it back toward profitability.

Why should you care? Because the same forces driving this turnaround, rate cuts, changing yields, shifting inflation, are the ones that hit your mortgage rate, credit card interest, and investment returns. When the Fed’s direction becomes clearer, so does the price of your debt and the growth path of your assets.

If this made Fed headlines feel a little less abstract, reply or share it with that friend who “doesn’t do economics”

“Tiny shifts at the Fed can mean big shifts in the cost of your money”

When the Fed stops bleeding cash, it’s a signal that the rate cycle is maturing. That doesn’t mean “all clear,” but it does mean the wildest swings in interest rates may be behind us, and that’s good news if you’re juggling student loans, a mortgage, and a brokerage account. Lower policy rates trickle into lower borrowing costs and lower yields on safe assets, forcing a rethink of your mix between cash, bonds, and stocks.

From a lifestyle angle, a more predictable rate path helps you plan: locking in a mortgage, refinancing high-interest debt, or finally committing to that long-term investing strategy without feeling like the ground is moving under you every month. The move now is not to “time the Fed,” but to align your money with where policy is likely headed: modestly lower rates, slower inflation, and more normal conditions.

Review your rates, your emergency fund, and your investing plan this week, and tweak at least one of them instead of just scrolling past the headlines.

Trump-Era Tariff Deal Cuts Costs on Korean Cars and Tech (Economic Conflict)

Big headline: tariffs on South Korean imports just dropped from 25% to 15%. Quiet headline: that could hit your car price and inflation bill.

U.S. Commerce Secretary Howard Lutnick confirmed that tariffs on imports from South Korea. including cars. are being cut to 15%, retroactive to November 1. Previously, those tariffs ran as high as 25% under a mix of national security and “reciprocal” measures. So what changed? South Korea moved ahead with legislation supporting roughly $350 billion in strategic investments in US industries like shipbuilding and manufacturing, unlocking key pieces of a bilateral trade deal tied to the Trump administration.

The new agreement doesn’t just lower tariffs on autos; it also removes tariffs on airplane parts and caps national-security tariffs on critical sectors like semiconductors and pharmaceuticals at 15%. On paper, that’s about geopolitics and industrial strategy. On your budget sheet, it’s about pressure on prices. Lower tariffs on imported cars and components make it easier for automakers to keep sticker prices and repair costs from spiraling even higher, especially when inflation and financing costs are already squeezing buyers.

This won’t magically slash your car payment next week, but it nudges in the right direction: fewer cost pressures flowing through supply chains.

If you’ve been side-eyeing car prices or new tech gear, share this with someone who’s planning a big purchase in 2026.

“Korea’s commitment to American investment strengthens our economic partnership and domestic jobs and industry”

This tariff shift shows how “economic conflict” headlines eventually land in very normal places, your car loan, your phone upgrade, your cost of living. Cutting tariffs reduces one layer of cost embedded in imported goods, which can help cool inflation at the margins over time. It’s not a firehose of savings, but it’s one less log on the price-hike bonfire.

From a lifestyle angle, cheaper imports mean more breathing room in categories that already crush budgets for 20-, 30-, and 40-somethings: transportation and tech. If you’re planning a major purchase, combine this macro shift with micro moves: negotiate harder, compare across brands that benefit from lower tariffs, and avoid stretching your loan term just to “make the payment fit.”

The move now: treat big-ticket items as long-term cash-flow decisions, not impulse buys justified by a headline about tariffs dropping.

Stocks Dip, Yields Climb as Markets Catch Their Breath

After a five-day rally, the market finally hit pause, and your portfolio probably felt it.

Wall Street just reminded everyone that stocks don’t move in straight lines. After five straight sessions of gains, the Dow slipped about 0.9%, the S&P 500 fell roughly 0.5%, and the Nasdaq dipped 0.4%, while U.S. 10-year Treasury yields climbed above 4.09%.(MarketScreener) Utilities, healthcare, and industrials led the losses, while energy stocks popped thanks to a bump in Brent crude prices. In other words: a classic “risk sentiment reset” day.

Behind the scenes, investors are digesting two big things: upcoming economic data (especially inflation and jobs numbers) and the Fed’s next move on interest rates. Higher yields mean borrowing costs stay elevated, which hits everything from corporate profits to your next car loan. At the same time, the expectation of more rate cuts is already priced in to a lot of growth names and even crypto, which makes markets vulnerable to any disappointment or “not as dovish as you hoped” Fed messaging.

For everyday investors, this isn’t a “panic” moment; it’s a reality check. Markets can rally hard on rate-cut optimism, but they can also overshoot and then pull back as traders take profits and rebalance.

If days like this make you want to rage-quit your brokerage app, forward this to a friend who needs the reminder that volatility ≠ doom.

“Today’s drop could be a combination of deleveraging from crypto and risk assets… and people taking some profits”

Logically, this kind of pullback is healthy. It shakes out leverage, forces traders to reassess their “rate cut fantasy,” and reminds long-term investors that risk assets come with actual, you know… risk. If you’re dollar-cost averaging into diversified funds, these dips are features, not bugs, they’re when new contributions buy more shares.

On the human side, watching a green streak snap can trigger all the usual emotions: regret (“I should’ve sold”), fear (“Is this 2008 again?”), or FOMO (“Did I miss the top?”). Instead of reacting, use days like this as a checklist moment: Are you over-concentrated in one sector, one stock, or one shiny crypto? Are you investing money you actually need in the next 3–5 years?

The call to action: take 15 minutes this week to rebalance or at least review your mix. If your plan only works in straight-up markets, it’s not a real plan.

Mortgage Rates Today: Is It Finally Refi Season Again?

Good news: if your mortgage rate starts with a 7, the math just flipped in your favor.

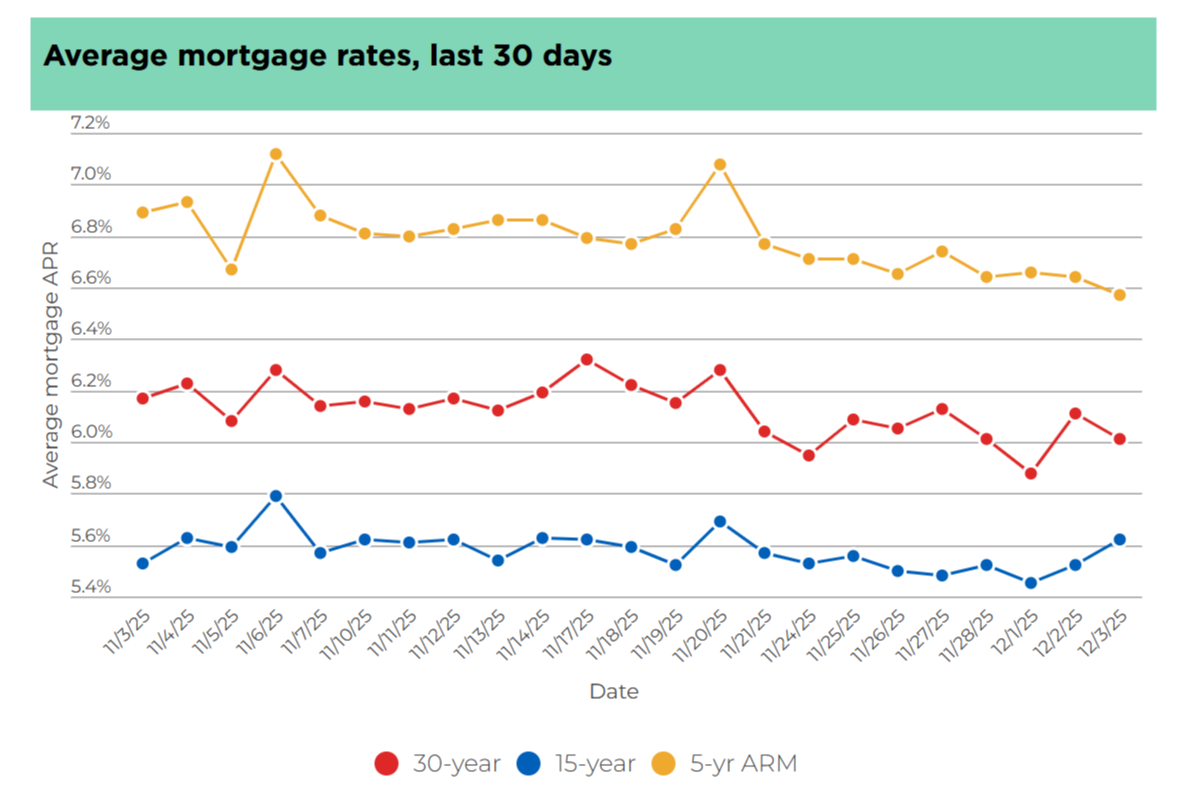

Today’s mortgage snapshot shows average rates hovering around the high 5s to low 6s for a 30-year fixed loan, with NerdWallet noting that refinancing starts to make sense once current rates are at least 0.5 to 0.75 percentage points below what you’re paying. If your existing mortgage is around 6.5% or higher, you’re officially in the “time to run the numbers” zone.

Lenders are still picky, your credit score, income, and home equity matter, but the context has changed. Earlier this year, 30-year rates were north of 7%. Now, the combination of Fed rate cuts, easing inflation, and shifting bond yields has quietly created a window for both refinancers and selective new buyers. The catch: closing costs, break-even timelines, and your plans to stay in the home still decide whether a refi is smart or just paperwork cosplay.

For first-time buyers, slightly lower rates help, but they don’t fix everything. Monthly payments are still high thanks to home prices and insurance costs. But shaving even 0.75 points off your rate over 30 years can mean tens of thousands in interest saved, money that can go toward investing, paying off other debt, or just upgrading life beyond “renting with extra steps.”

If you don’t know your current rate off the top of your head, reply to this as your nudge to dig up that statement tonight.

“With rates where they are today, you could start considering a refi if your current rate is around 6.51% or higher”

The logical lens: refinancing is a math problem, not a vibe. Compare your current rate to today’s, estimate closing costs, and calculate your break-even point, the month where cumulative savings exceed what you paid to refi. If you plan to stay beyond that, the numbers may justify the hassle.

Lifestyle-wise, dropping your monthly payment by even $150–$300 can be huge. That’s extra room for investing, building an emergency fund, or finally attacking that 20% APR credit card balance. For a lot of 23- to 49-year-olds carrying multiple financial priorities, freeing up cash flow beats flexing a low rate on Instagram.

Your call to action: schedule 30 minutes this weekend to get at least one real quote, from your current lender or a new one, and compare it with your existing mortgage. Information is free; inaction is what’s expensive.

Where Home Prices Are Heading This December, And What To Do

If you’ve been waiting for a housing “crash,” December’s numbers might disappoint you.

News dug into where home prices are heading into December, and the message is… annoyingly balanced. Prices aren’t collapsing, but they’re not exploding either. In many markets, the combination of still-limited supply, slightly lower mortgage rates, and steady demand means prices are either inching higher or plateauing instead of giving buyers the fire-sale they were promised on TikTok.

For buyers, that means the “I’ll jump in when prices tank” strategy is getting harder to defend. Even modestly lower rates can bring more buyers off the sidelines, which helps support prices, especially in markets with strong job growth and limited new construction. On the seller side, many homeowners locked into super-low pandemic-era rates are staying put, keeping inventory tight and preventing a broad drop in values. That’s great for equity, less great if you want to upgrade without doubling your payment.

The article underscores a key theme: timing the housing market is just as dangerous as timing the stock market. Local dynamics, not national headlines, dominate: some metros will cool, some will grind higher, some will finally normalize.

If you’re house-curious but market-confused, share this with your “Zillow-scrolling at midnight” friend and compare notes.

“Deciding whether it’s a ‘smart’ time to buy is less about timing the market and more about your own financial readiness”

The smart way to read this: housing isn’t about catching a perfect bottom; it’s about matching your purchase to your life and your cash flow. If prices are flat-ish but you’re financially ready, stable income, healthy emergency fund, manageable debt, and a realistic budget, then waiting purely on principle can cost you years of potential equity and stability.

From a lifestyle view, homeownership isn’t mandatory, but it can be a powerful forced-savings and stability tool for families, couples, and solo earners alike. The move isn’t “buy anything now” , it’s “get hyper-local”: Talk to a trusted agent, study your specific zip codes, and run payment scenarios at today’s rates.

Your call to action: instead of doomscrolling national housing takes, spend 20 minutes this week looking up real comps and rents in the exact areas you’d actually live. Reality beats headlines every time.

This Week’s Video:

Most people reach December in the same place they started the year, but you can flip the next 30 days into real momentum if you strip your life down to one clear goal, two habits that drive it, and a commitment to cut distractions. Treat this month as separation season while everyone else coasts: protect your first 90 minutes for deep work, skip the late nights, double your key habit on one weekend day, and set daily non-negotiables for your body, mind, and business. Call out your excuses, remove the time assassins that drain you, track every small win, share your progress publicly for accountability, and take imperfect action today instead of waiting for the perfect moment. The faster you start, the faster you shift into the version of yourself you keep dreaming about.

If you made it this far, your money brain is officially above average. This week was all about how big, boring words, tariffs, rate cuts, deferred assets, quietly decide the price of your house, your car, and your future wealth.

Hit reply and tell me: which of these stories actually changes what you’ll do this month? And if you know someone who’s still flying blind on this stuff, forward this their way.

Next week, we’ll dig into how to build “recession-proof” cash flow without becoming a full-time hustle zombie.