From Piggy Banks to Blockchain: Your Weekly Money Moves . Financially Enabled #94 September 18th, 2025

Gen Z’s median emergency fund is only $400 while many boomers have five times more, leaving one in three U.S. adults with nothing saved and most saying rising prices make even a small cushion feel out of reach. At the same time, builders are slashing single‑family housing starts by 7 %, cutting back on new projects as unsold inventories pile up and permits sink to a two‑year low, even though mortgage rates have eased slightly. In Britain, regulators are mulling a light‑touch approach to crypto by waiving rules that require trading platforms to act with integrity and put customers first; officials say they want to “balance innovation, market integrity and trust”, though proposals still call for tighter operational‑risk standards and acknowledge that about 12 % of British adults own or have owned crypto. Investors watching the Fed see small‑cap stocks ready to benefit from cheaper borrowing while banks face squeezed margins and tech giants ride the prospect of lower discount rates; meanwhile utilities and homebuilders have rallied but may need multiple cuts to fully recover. And in Switzerland, UBS, PostFinance and Sygnum completed the first legally binding payment using tokenized bank deposits on a public blockchain ,a proof of concept showing that tokenized deposits can settle across banks and might one day offer an alternative to stablecoins.

Want to unpack how these trends affect your wallet or just nerd out on money with others? Join my Skool community and keep the conversation going!

When a $400 Cushion Isn’t Enough: Gen Z’s Savings Squeeze

Could a flat tire tank your finances? It could for millions of Americans.

A new Empower survey shows one in three Americans has no emergency savings. The gap between generations is striking: Gen Zers have just $400 stashed away on average while boomers average $2,000. About 75 % of respondents said an emergency fund is vital, yet rising prices, high interest rates and stagnant wages make saving a struggle. More than half say it feels “almost impossible” to build a cushion, and almost half admit they have less saved than a year ago. Inflation is still running above the Fed’s target, rent keeps climbing, and entry‑level jobs are scarce. It’s no wonder Gen Z debt tops $94,000, leaving many feeling underwater. Amid this squeeze, financial advisors urge saving 20 % of income, but that can sound daunting. Start smaller: automate a weekly transfer of whatever you can, and watch your fund grow.

How much could you set aside this week? Hit reply and let us know.

More than half say saving for emergencies feels ‘almost impossible’ with how expensive everything is right now.

Even a tiny emergency fund can prevent a surprise bill from becoming high‑interest debt. Build the habit: set up automatic transfers the day after payday and treat your savings like a non‑negotiable bill. You’ll sleep better knowing a flat tire or dentist visit won’t wreck your budget. Ready to start? Open a high‑yield savings account and stash that first $10 today.

Housing Starts Sink as Builders Hit the Brakes

Dreaming of a starter home? You might want to slow your scroll.

U.S. single‑family home construction plunged 7 % in August to an annual rate of 890,000 units, the weakest pace since April 2023. Builders are drowning in unsold houses and are slashing new projects accordingly. Permits for future single‑family homes fell 2.2 %, while overall housing starts dropped 8.5 %, and multi‑family permits slid 6.7 %. Mortgage rates have eased to around 6.35 %, but they still make monthly payments hard to swallow. Economists warn that lingering high borrowing costs, sluggish job growth and a glut of inventory could keep home sales depressed. For prospective buyers, that might mean more price cuts ahead but fewer new homes hitting the market. Thinking about buying? Use this lull to build your down payment, clean up your credit and follow rate trends.

Have questions about saving for a home? Ask away ,we’re listening.

Single‑family housing starts fell 7.0 % to a seasonally adjusted annual rate of 890,000 units last month.

When builders pause, buyers get a mixed bag: prices might soften, but choices shrink. Use the breather to strengthen your finances ,pay down debt, boost your credit score and increase your down payment. That way, when rates drop, you’re ready to act. Want help mapping out a home‑buying plan? Reply to this email and we’ll point you to resources.

Integrity Optional? UK Proposes Light‑Touch Crypto Rules

Imagine running a crypto exchange without pledging to be honest.

Britain’s Financial Conduct Authority is floating a plan to let crypto‑trading platforms skip four of its guiding principles ,including the duty to act with integrity and to put customers first. The idea: make London more attractive to digital‑asset businesses and rival more permissive jurisdictions. Regulators say they still want high operational‑risk standards after a $1.5 billion hack earlier this year and that the consultation is about balancing innovation with trust. Around 12 % of British adults have owned crypto, and feedback on the proposals is open until November 12. Critics fear light‑touch rules could invite bad actors; supporters say they’re needed to foster growth. If you dabble in crypto, double‑check the platform’s safeguards and remember these assets remain volatile.

Curious where regulation goes next? Chime in with your take.

We want to develop a sustainable and competitive crypto sector – balancing innovation, market integrity and trust.

Regulatory easing could boost crypto innovation but heighten risks for unwary investors. Before buying tokens, research the exchange’s track record and security measures. Diversify your portfolio so a crypto crash won’t derail your finances. Interested in dipping a toe? Start small, learn the basics and never invest money you can’t afford to lose.

What’s your crypto comfort level? Hit reply and share.

Rate Cut Watch: Sectors Poised for a Fed Move

If interest rates fall, who stands to benefit the most?

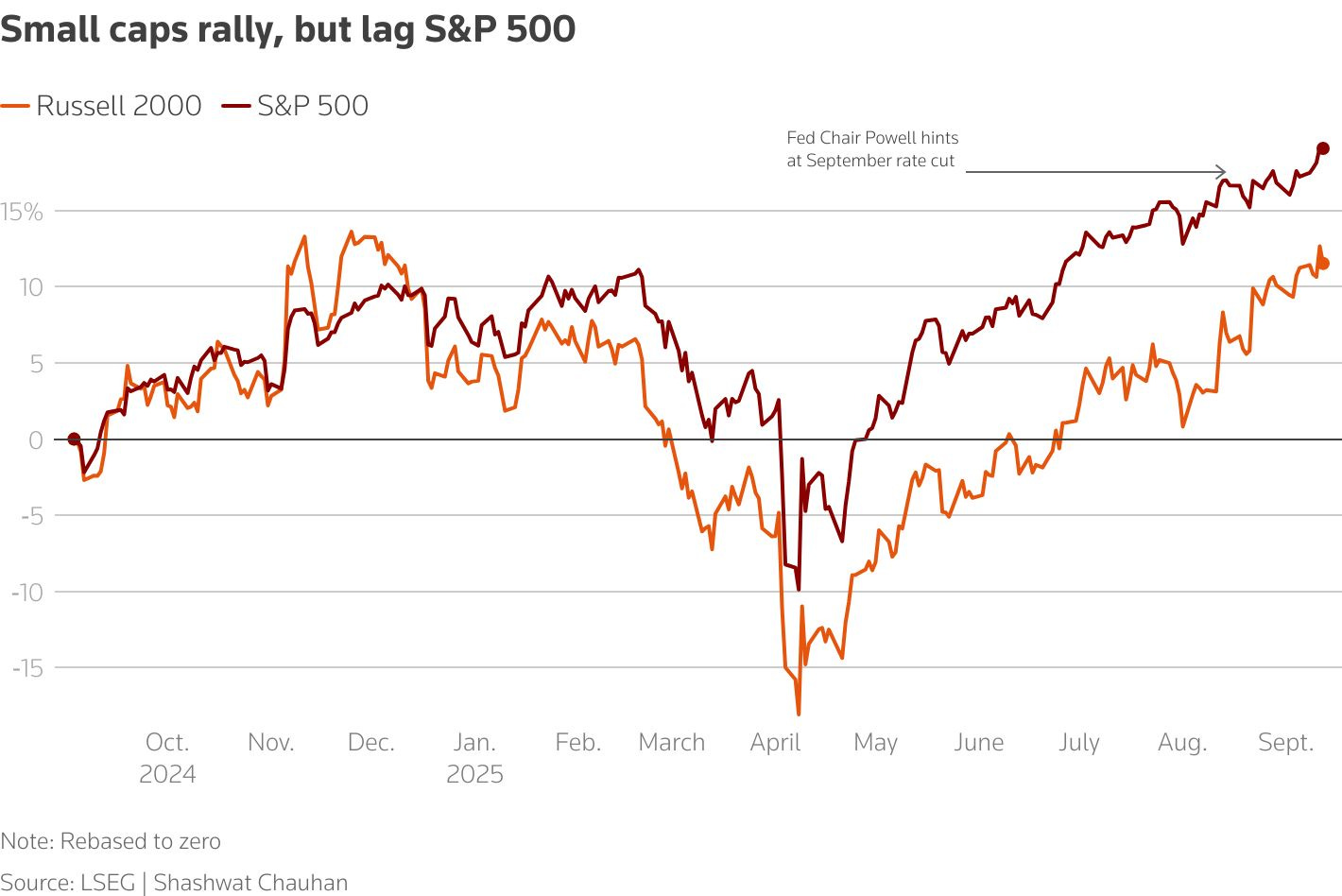

With the Federal Reserve expected to trim borrowing costs by at least 25 basis points, investors are eyeing sectors that thrive on cheap money. Small‑cap companies, which rely heavily on external financing, could see their available capital increase. Banks might not celebrate: lower rates shrink the gap between short‑ and long‑term yields and squeeze profit margins. Growth and tech stocks often get a bump because their valuations depend on future earnings, while utility shares ,often seen as bond substitutes ,have rallied on expectations of cuts. Homebuilder and housing stocks need multiple cuts to revive demand; high mortgage rates still weigh on buyers. Markets have mostly priced in the first cut and expect two more by year‑end. Watching these moves can be educational, but chasing hot sectors can backfire. Want to know how rate changes could affect your investments? Drop us a line.

Small‑cap companies are largely reliant on external borrowing to fund their operations, and lower borrowing costs increase their available capital.

Interest‑rate cuts don’t lift all boats equally. Rate‑sensitive sectors may jump, but timing the market is tricky. Use this moment to review how much of your portfolio depends on debt‑heavy companies or banks. Stay diversified ,own a mix of sectors so you’re not betting your future on a single Fed decision.

Need a second set of eyes? Reach out and we’ll talk through your game plan.

Swiss Banks Try Tokenized Deposits - Payments Go Blockchain

What if your paycheck could travel on a blockchain highway?

UBS, PostFinance and Sygnum just executed the first binding payment using tokenized bank deposits on a public blockchain. In their pilot, customers sent tokens that represent actual bank deposits across institutions, settling instantly. The banks say these deposit tokens could form a new payment rail ,an alternative to stablecoins ,allowing fast, final transfers between banks and into business processes. For now, it’s a proof of concept; regulators and technologists still need to iron out rules and ensure it’s safe. If deposit tokens take off, they could streamline cross‑bank payments and reduce fees. But they aren’t the same as cryptocurrencies; they’re backed by traditional deposits and governed by banks.

Would you trust your paycheck on a blockchain? Tell us.

Our tokenized deposits can be used across different banks, which is something that was not there yet.

Tokenized deposits could make moving money as easy as sending a text. They might reduce settlement times, cut costs and blur the line between banking and fintech. The flip side: new tech means new risk, and regulation will lag innovation. Keep an eye on your bank’s digital offerings and ask about FDIC‑insured accounts with mobile features.

Curious about digital banking tools? Drop your questions ,we’ll explore them in an upcoming issue.

Video of the week: Make Your Money Work for You

Many people assume that keeping money in the bank will protect their wealth, but inflation quietly erodes its value. Building wealth demands action: grow your income, cut unnecessary costs, and invest in assets that appreciate. Start by tracking every expense for a few months to see where money leaks out and pay down high-interest debt first. Explore investments like index funds or a balanced mix of assets rather than relying on savings or buying a house. Renting can free up capital to invest, and a pension alone won’t fund a comfortable retirement. Avoid the myth of easy passive income and understand that real gains require discipline and thoughtful risk. Surround yourself with people who motivate and challenge you, leverage your skills to earn more, and stay flexible to seize opportunities. How are you planning to make your money work harder for you?

Thanks for sipping on today’s money stories with us. If you learned something new, hit reply to share your thoughts or forward this to a friend who’d appreciate a smarter take on the week’s headlines. Next week we’ll dig into student‑loan repayment hacks and the rise of no‑fee budgeting apps. Stay tuned and stay curious!