Fee wars, BNPL scores, and health-plan sticker shock. Financially Enabled #84 June 26th, 2025

Vanguard just lobbed another salvo in the ETF price war, trimming bond-fund fees and daring rivals to follow. FICO will soon bake your buy-now-pay-later tabs into credit scores, turning impulse sneakers into long-term karma. Auto-enroll tweaks are pushing 401(k) contributions to record highs while a headline-grabbing tax overhaul sketches bigger paychecks—and bigger deficit warnings. Capping it off, new tariffs are already rippling into next year’s health-insurance premiums. Sip the wins, flag the risks, then tell us which move lands first on your money to-do list.

Vanguard slices ETF fees, investors pocket extra basis points

Could your bond fund cost less by the weekend.

Two days ago Vanguard trimmed expense ratios on seven European bond ETFs by two basis points, part of what the company calls its largest global fee cut of the year. The move drops the average cost of those funds to eleven one-hundredths of a percent and echoes a February slash that saved U.S. investors three hundred fifty million dollars. CEO Salim Ramji says low fees are rocket fuel in a higher-yield world where every basis point compounds faster. Why care if you do not own those exact tickers. Fee wars never stay regional for long, and U.S. bond ETFs with similar mandates traded heavier the very next session. Seen a fund you hold cut costs lately. Hit reply and brag. ft.com

Paying a tenth of a percent instead of twenty five adds roughly four thousand dollars to a fifty-thousand dollar stake over ten years at five percent growth. Feeling. Lower costs feel like a quiet raise that shows up statement after statement. Action. Check the expense ratio column of your core funds tonight and switch to the cheapest class your brokerage offers if it tracks the same index.

Buy-now-pay-later loans will soon hit credit scores

Your next pair of sneakers could follow you onto your credit report.

FICO just announced that its updated models will include buy-now-pay-later data starting this fall. Analysts say ninety-one million Americans are on track to use BNPL in twenty twenty five, and LendingTree finds forty one percent already missed at least one payment. Gen Z leads the parade with multiple overlapping loans and lighter credit card history, making them most at risk for score slips. Lenders love the extra insight, regulators are watching, and users who pay on time might actually gain a few points. Do you juggle pay-in-four plans now. Tell us whether this news chills or cheers you. businessinsider.com

A thin file plus three BNPL lines can look like unsecured debt and shave dozens of points. Feeling. Seeing a favorite hoodie hurt a future mortgage hurts more than paying interest. Action. Set automatic payments for every plan and keep total BNPL balances below ten percent of monthly take-home pay.

New 401k design tweaks nudge savers to record contributions

Auto pilot is finally steering retirement accounts in the right direction.

Vanguard’s How America Saves report released yesterday shows forty five percent of participants increased deferral rates in twenty twenty four, the highest share on record. Plans that pair auto enrollment with annual one percent bumps hit a median savings rate of ten percent, versus seven percent for old-school opt-in setups. Hardship withdrawals edged up only slightly, suggesting the forced-saving push did not spark cash emergencies. Vanguard credits employer matches that start at day one and target date funds that dial risk automatically. Does your plan still leave you to choose every knob and dial. Share the feature you wish HR would add.

Moving from seven to ten percent on a sixty-thousand salary adds roughly one hundred fifty thousand dollars to retirement balances over thirty years at six percent growth. Feeling. Watching the match hit sooner feels like free momentum. Action. Log in and crank your deferral by one percent today then set a calendar nudge for the same boost next January.

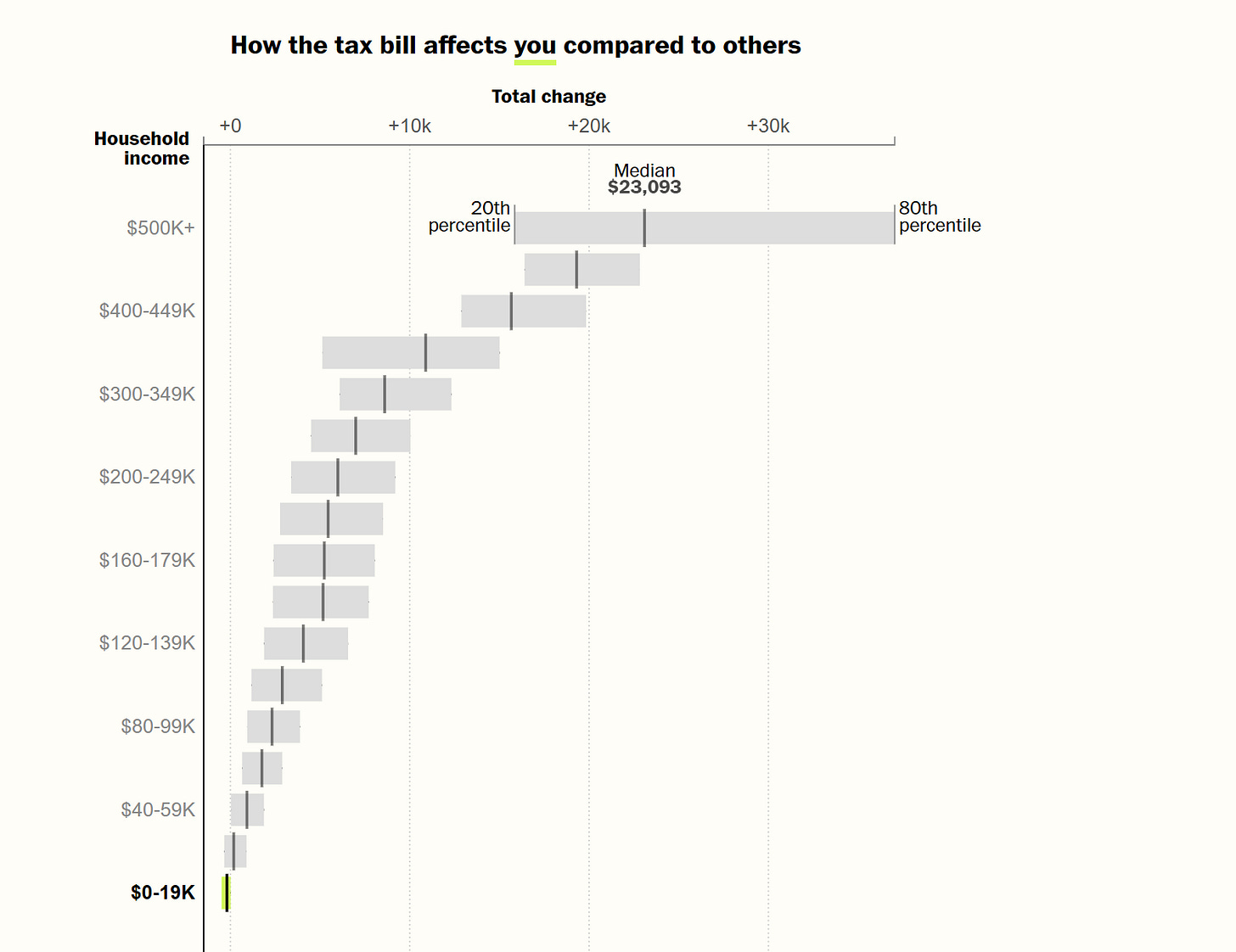

Trump’s tax makeover promises winners and warning signs

A bill called One Big Beautiful Act just dropped and it is anything but simple.

Unveiled this morning, the proposal makes the twenty seventeen tax cuts permanent, exempts tips and overtime from income tax, lifts the SALT cap to forty thousand dollars for most households, and bumps the child credit to twenty five hundred through twenty twenty eight. The catch is big. The plan pares Medicaid and SNAP funding, raising the risk of sixteen million people losing coverage, and balloons deficits according to early CBO math. Estate tax thresholds would double, handing high-net-worth families a multibillion dollar break. Love or loathe it, the bill sets the table for a noisy election-year tax debate. Curious what your bottom line looks like. Check the linked calculator then report back. washingtonpost.com

Temporary credits can pad cash flow yet vanish mid mortgage. Feeling. A larger paycheck feels hollow if health coverage shrinks. Action. Run the numbers now and plan to adjust withholding only after final votes shape the real law

.

Tariffs push health insurers to signal premium jumps (Economic Conflict)

Steel and silicon tariffs may soon hit your health-plan renewal letter.

Advisory Board reports that multiple insurers told regulators this week they expect to raise individual and small-group premiums for twenty twenty six by up to eight percent to offset supply chain price shocks. Medical devices, construction steel for hospitals, even imported generic drugs all carry the new duties announced in May. Actuaries warn the ripple can grow if providers bake higher equipment costs into procedure rates. Employers already bracing for a mid single digit hike could see double digits instead. Have you priced next year’s plan yet. Reply with the quote and we will crowd map the pain. advisory.com

Every one percent rise on a seven-thousand dollar premium equals seventy dollars lost compound interest if left uninsured in a health savings account. Feeling. Surprise hikes sting more than the annual flu shot. Action. Compare high deductible plans paired with an HSA now and press HR about open enrollment wellness credits that soften the blow.

Which story hit your wallet vibes the hardest. Hit reply with a win or a rant, then forward this letter to a friend who still thinks tariffs stay in textbooks and BNPL never meets Equifax. Next week we unpack hidden airline fees and test drive the new IRS Direct File expansion. Your future self will thank you.

10 Hacks to Unlock Superhuman Productivity by Dan Martell

Make a Not-to-Do List: Focus is about subtracting distractions, not adding tasks. By saying no to low-value tasks, bad habits, and energy-draining people, you streamline your energy toward what truly matters.

Create Focus Triggers: Build intentional routines and environments that trigger your brain into focus, like specific locations, sounds, and habits that help you get into a flow state effortlessly.

Start on Hard Mode: Tackle difficult tasks first to build momentum and confidence. Prioritize the "one thing" that makes the biggest impact on your goals.

Be Hard to Reach: Minimize distractions by turning off notifications, scheduling response times, and using focus signals to protect your time and maintain concentration.

Turn Up the Pressure: Shorten your deadlines and increase the stakes to force action. By creating a sense of urgency, you tap into higher levels of productivity.

Dan Martell shares strategies on how to unlock your focus, work smarter, and achieve more with intentionality and discipline.